Enterprise Risk

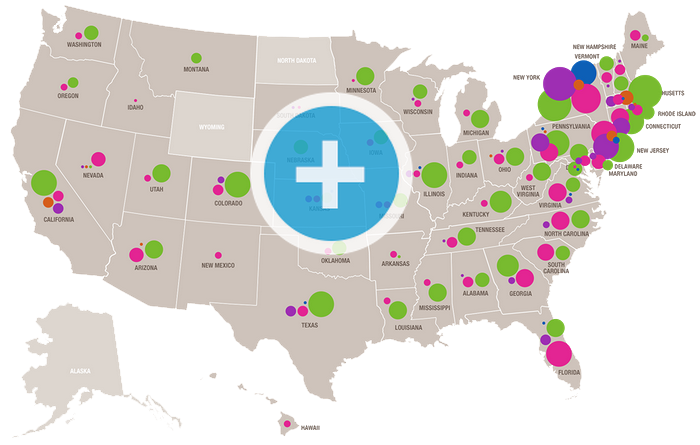

The five companies and respective businesses that comprise Con Edison are influenced by many factors that are difficult to predict, and that involve uncertainties that may materially affect actual operating results, cash flows and financial condition. The companies have established an enterprise risk management program to identify, assess, manage and monitor its major business risks based on established criteria for the severity of an event, the likelihood of its occurrence, and the programs in place to control the event or reduce the impact. The companies also have financial and commodity market risks.

A robust discussion of each enterprise risk below is located here on pages 27-32 of Con Edison’s 2013 Annual Report.

- The failure to operate energy facilities safely and reliably could adversely affect the companies

- The failure to properly complete construction projects could adversely affect the companies

- The failure of processes and systems and the performance of employees and contractors could adversely affect the companies

- The companies are extensively regulated and are subject to penalties

- The utilities’ rate plans may not provide a reasonable return

- The companies may be adversely affected by changes to the utilities’ rate plans

- The companies are exposed to risks from the environmental consequences of their operations

- A disruption in the wholesale energy markets or failure by an energy supplier could adversely affect the companies

- The companies have substantial unfunded pension and other postretirement benefit liabilities

- Con Edison’s ability to pay dividends or interest depends on dividends from its subsidiaries

- The companies require access to capital markets to satisfy funding requirements

- A cyber attack could adversely affect the companies

- The companies also face other risks that are beyond their control