Report Introduction

Company Profile

Consolidated Edison, Inc. is one of the nation’s largest investor-owned energy-delivery companies, with approximately $12 billion in revenues and $63 billion in assets. The company provides a wide range of energy-related products and services to its customers through the following subsidiaries:

Consolidated Edison, Inc. is one of the nation’s largest investor-owned energy-delivery companies, with approximately $12 billion in revenues and $63 billion in assets. The company provides a wide range of energy-related products and services to its customers through the following subsidiaries:

- Consolidated Edison Company of New York, Inc. (CECONY), a regulated utility providing electric, gas and steam service to customers in New York City and Westchester County, New York

- Orange & Rockland Utilities, Inc. (O&R), a regulated utility serving customers in a 1,300-square-mile-area in southeastern New York State and northern New Jersey

- Con Edison Clean Energy Businesses, Inc. (CEB),which through its subsidiaries develops, owns and operates renewable and sustainable energy infrastructure projects and provides energy-related products and services to wholesale and retail customers

- Con Edison Transmission (CET), which through its subsidiaries invests in electric transmission projects to bring clean energy to customers.

Revenue by Business (million $)

- CECONY Electricon

- CECONY Gason

- CECONY Steamon

- O&R Electricon

- O&R Gason

- CEBson

- CETon

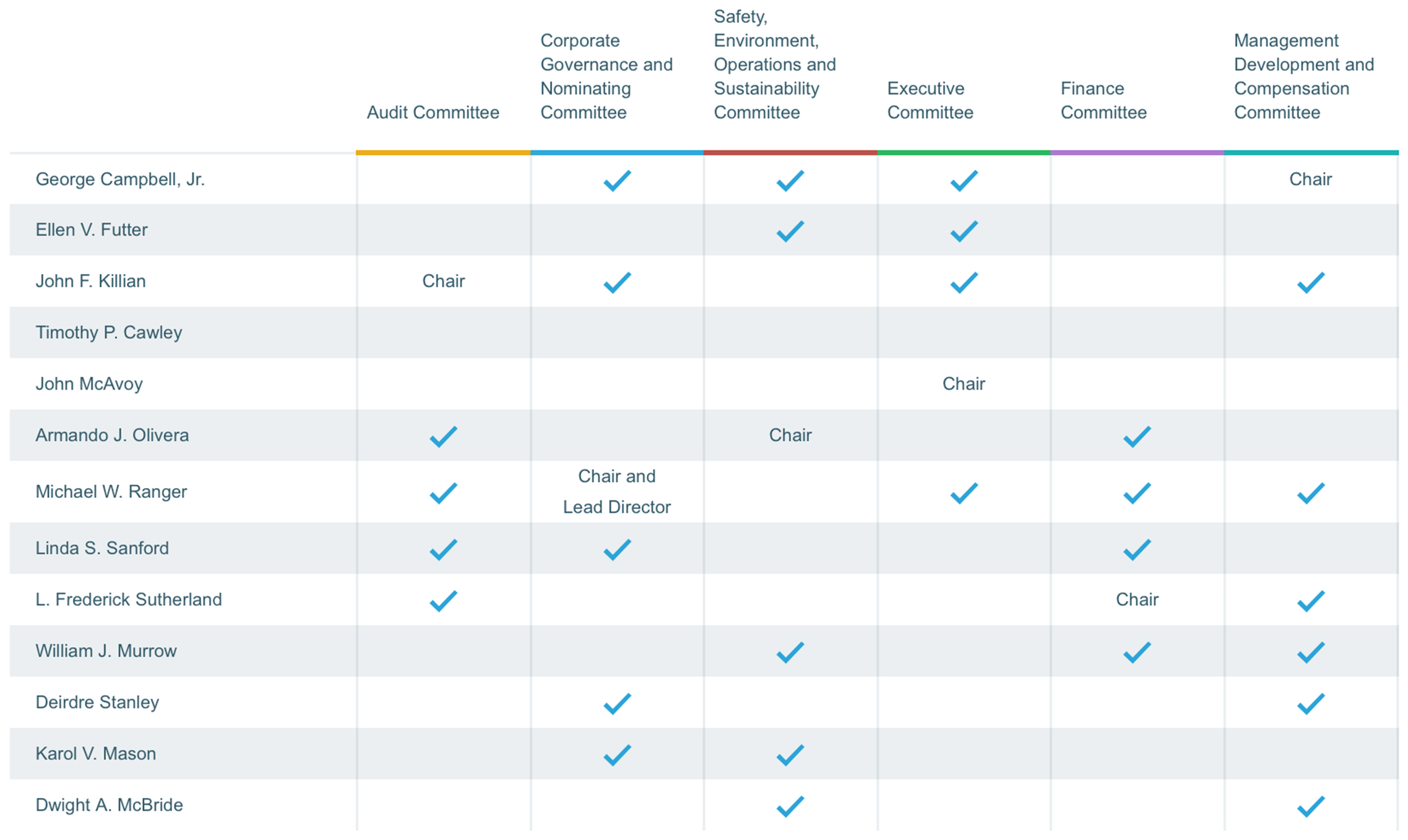

Board of Directors

Board of Directors

| Audit Committee | Corporate Governance and Nominating Committee | Safety, Environment, Operations and Sustainability Committee | Executive Committee | Finance Committee | Management Development and Compensation Committee | |

|---|---|---|---|---|---|---|

| George Campbell, Jr. |  |

|

|

Chair | ||

| Ellen V. Futter |  |

|

||||

| John F. Killian | Chair |  |

|

|

||

| Timothy P. Cawley | ||||||

| John McAvoy | Chair | |||||

| Armando J. Olivera |  |

Chair |  |

|||

| Michael W. Ranger |  |

Chair and Lead Director |  |

|

|

|

| Linda S. Sanford |  |

|

|

|||

| L. Frederick Sutherland |  |

Chair |  |

|||

| William J. Murrow |  |

|

|

|||

| Deirdre Stanley |  |

|

||||

| Karol V. Mason |  |

|

||||

| Dwight A. McBride |  |

|

| George Campbell, Jr. | |

|---|---|

| George Campbell, Jr. | |

| Corporate Governance and Nominating Committee |

|

| Safety, Environment, Operations and Sustainability Committee |

|

| Executive Committee |

|

| Management Development and Compensation Committee | Chair |

| Ellen V. Futter | |

| Ellen V. Futter | |

| Safety, Environment, Operations and Sustainability Committee |

|

| Executive Committee |

|

| John F. Killian | |

| John F. Killian | |

| Audit Committee | Chair |

| Corporate Governance and Nominating Committee |

|

| Executive Committee |

|

| Management Development and Compensation Committee |

|

| Timothy P. Cawley | |

| Timothy P. Cawley | |

| John McAvoy | |

| John McAvoy | |

| Executive Committee | Chair |

| Armando J. Olivera | |

| Armando J. Olivera | |

| Audit Committee |

|

| Safety, Environment, Operations and Sustainability Committee | Chair |

| Finance Committee |

|

| Michael W. Ranger | |

| Michael W. Ranger | |

| Audit Committee |

|

| Corporate Governance and Nominating Committee | Chair and Lead Director |

| Executive Committee |

|

| Finance Committee |

|

| Management Development and Compensation Committee |

|

| Linda S. Sanford | |

| Linda S. Sanford | |

| Audit Committee |

|

| Corporate Governance and Nominating Committee |

|

| Finance Committee |

|

| L. Frederick Sutherland | |

| L. Frederick Sutherland | |

| Audit Committee |

|

| Finance Committee | Chair |

| Management Development and Compensation Committee |

|

| William J. Murrow | |

| William J. Murrow | |

| Safety, Environment, Operations and Sustainability Committee |

|

| Finance Committee |

|

| Management Development and Compensation Committee |

|

| Deirdre Stanley | |

| Deirdre Stanley | |

| Corporate Governance and Nominating Committee |

|

| Management Development and Compensation Committee |

|

| Karol V. Mason | |

| Karol V. Mason | |

| Corporate Governance and Nominating Committee |

|

| Safety, Environment, Operations and Sustainability Committee |

|

| Dwight A. McBride | |

| Dwight A. McBride | |

| Safety, Environment, Operations and Sustainability Committee |

|

| Management Development and Compensation Committee |

|

As of January 1, 2021.

Financial Highlights (million $ except per-share information and statistical data)

|

|

2014 |

2015 |

2016 |

2017 |

2018 |

2019 |

2020 |

|---|---|---|---|---|---|---|---|

|

Operating revenues |

$12,919 |

$12,554 |

$12,075 |

$12,033 |

$12,337 |

$12,574 |

$12,246 |

|

Net income for common stock |

$1,092 |

$1,193 |

$1,245 |

$1,525 |

$1,382 |

$1,343 |

$1,101 |

|

Basic earnings per common share |

$3.73 |

$4.07 |

$4.15 |

$4.97 |

$4.43 |

$4.09 |

$3.29 |

|

Dividends per share |

$2.52 |

$2.60 |

$2.68 |

$2.76 |

$2.86 |

$2.96 |

$3.06 |

|

Dividend payout ratio |

68% |

64% |

65% |

56% |

65% |

72% |

93% |

|

Average common shares outstanding |

292.9 |

293 |

300.4 |

307.1 |

311.7 |

328.5 |

334.8 |

|

Total assets |

$44,071 |

$45,642 |

$48,255 |

$48,111 |

$53,920 |

$58,079 |

$62,895 |

|

Capital expenditures |

$2,721 |

$3,418 |

$5,235 |

$3,606 |

$5,249 |

$3,676 |

$4,085 |

|

Common equity ratio |

52.2% |

52.1% |

49.3% |

51.1% |

49.0% |

49.6% |

48.3% |

|

Return on equity |

8.8% |

9.3% |

9.1% |

10.4% |

8.8% |

8.2% |

7.6% |

|

Market capitalization |

$19,300 |

$18,800 |

$22,100 |

$26,100 |

$24,500 |

$30,100 |

$24,700 |

|

Stock price per share (year end) |

$66.01 |

$64.27 |

$73.68 |

$84.95 |

$76.46 |

$90.47 |

$72.27 |

|

Dividend yield (year end) |

3.8% |

4.0% |

3.6% |

3.2% |

3.7% |

3.3% |

4.2% |

|

Total shareholder return |

24.8% |

1.4% |

18.9% |

19.3% |

(6.6%) |

22.5% |

(17.0%) |